Finding Value During Volatility: Investors Are Shifting

The economic forecast keeps changing, but that doesn't mean people aren't preparing.

Hi, Hello, Hey Hey -

It’s no shocker that we are seeing the economy moving with a bit more autonomy due to seeing a tug-of-war between interest rates and inflation. While the topic of a recession keeps being halted like some regional bank stocks waiting for shifts in GDP, more and more people are starting to move towards recession prep. People are starting to save more of what they can and invest where they feel they have less risk of a [market] diss. Also adding to that sandwich was the inverted yield curve, wars, supply chain, and debt ceiling among other things. The Recession forecast keeps looking different no matter where you are.

No matter what the GDP says, people are learning from other situations to prepare for whatever landing we find in the future. Yes, unemployment claims are shifting down but the number of those getting laid off is going up. The rest of the world is going through recession preparation, so how does that mean we can’t expect to see some scale of a recession - group project or personal recession?

“Finding value during volatility” is something that I’ve been saying since the start of the pandemic, but it comes from looking and leveraging insights about not only the ‘08 recession but also critical economic moments like the 1971 Dollar Crisis or the Great Depression. Heck, no one really focused on the Covid Recession that was seen in February/March 2020 with no real recovery being seen as of yet. What I mean by “Finding value during volatility” is to look for opportunity within moments of opposition, especially when it comes to investing. I’ve also been saying for us to not think of those economic situations as same-ies but cliff notes/blueprints of what we could be facing in the upcoming year or so.

One of the areas that we are seeing more people (economists of profession or personal) starting to examine their retirement and brokerage with a bit tighter of a watch. One article that I found was that more advisers are starting to advise their clients to move more towards ETFs/Index Funds than Mutual Funds. While they are related a bit, this move is giving a signal of rebalancing risk tolerance even with the stock market not responding as expected towards the economy before there’s a need to. Remember me speaking about Feb/March of 2020? Well, a lot of folks not only learned how their retirement accounts are indeed tied to the stock market, but how the value went to pits. Once seen as a way to build wealth, which I still believe, ETFs have been performing better in this climate.

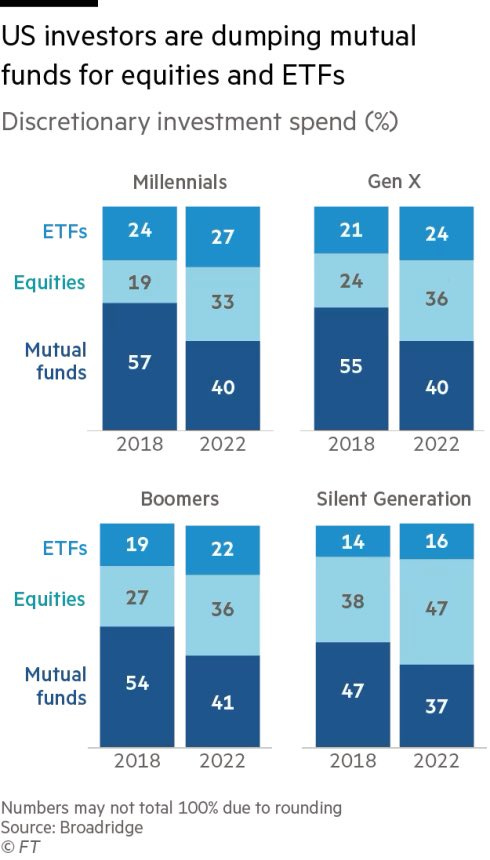

Investors withdrew $920.2bn from mutual funds up through February and added $528.7bn to ETFs (Morningstar Direct). This has shown at institutional layers that the traditional way of investing is shifting. As someone who understands and gives insight into the indie and institutionalization of things - I do believe that non-institutional investors (you), have been doing the same. I mean, this chart from Broadridge shows how different generations are starting to move more into ETFs and equities than mutual funds:

Most of the content that you might digest about investing is the lazy side (which is more leverage than lazy) of bucketing your holdings into ETFs and Index Funds, but understanding how they fit within your portfolio objectives is key for knowing how you build your diversification when it comes to ETFs.

Some of the things to look for in ETFs:

Expense Ratios: This ratio shows how much it costs for this fund to run - from portfolio management to distribution. Good ones are typically 0.5% to 0.75%.

Top Holdings: Some experts say to look within the Top 10, and 25 holdings to gain perspective on how the prospectus will act in your favor. Why this is important is that it can show you not only the weight but also not have you buying the same thing twice.

The Fund’s Liquidity: Cash rules everything around me - especially how much cash a company and in this case, fund, has. This will allow you to know the ease the fund has to make moves or manage overall.

Performance: There are a ton of new ETFs popping up like new TikTok trends, but I watch not only how the overall fund performs, the holdings but also how old the fund is. You don’t want to buy the hype without doing the homework on how something would fit within your portfolio. Yes, hype pays then but if not managed later will give you a headache.

*Another thing about performance is to keep in mind about the managing fund itself.How are they managing and moving with other funds as well.

Also talked about the types and other things here and here.

But when it comes to building your Portfolio Stack is to understand:

Strategy: The strategy you set for your finances will funnel down to your portfolio - brokerage, retirement, real estate, etc. Aligning with your long-term and short-term pockets will allow you to know what products match your position and the pocket you are working with. ETFs are a good way to structure your exposure and enlightenment with insights for better-implemented building.

Sectors: What sectors ( groups or classes of types of industries) do you find that match up to not only which ETFs you grab but how you’re moving as an investor. When you identify which you’re focused on (not just one), you research ETFs that align gradually building your portfolio stack.

Sentiments: How you’re feeling about the market, in general, will impact how you “see” your investments - ETFs or everyday seen stock. One of the things I recommend is not to let your feelings crack your views of how you’re investing. Yes, layoffs are happening but how can you leverage to find what funds/stocks/alts will hold during this uncertainty? Panic portfolios do not hold up well in any economy unless you’ve mastered how to continuously build while the BS happens.

Scale: You don’t grow your holdings to Warren status overnight. Part of your strategy will be to scale what you know and how you grow your stack. ETFs allow you to hold companies you’re unsure about but know that the overall ETF is crushing it. These types of funds help give you the rewards of investing without the risk of how the market can turn on you.

ETFs along with Index Funds are amazing ways to invest, no matter the climate, but understanding how that looks in your portfolio (long and short term) is key to building more rewards among the risks.

These funds are good, no matter if you’re starting out or have been steady with investing. Investors just want to cut their risk during this economy, I’m not mad at it. Practice the K.I.S.S method when it comes to them - Keep. It. Steady. Stacking. No, I wasn’t going to call you stupid :).

The starter pack for ETFs/Index Funds? $SPY, $VT, $VOO, $ITOT are just a few. Research before reaching before reaching for your wallet (to buy).

What do you think about the ETF landscape right now? How are you leveraging them to build your Portfolio Stack?

To get more tips about preparing for this economic shift, check out my Plan It, Don’t Panic playlist on YouTube.