Has the news about Apple Savings taken over your timeline?

No, you will not be entitled to compensation. But you will be entitled to know what the news about Apple Savings means not only about Apple as a company but what we could expect to see when it comes to the banking industry. While it’s just another High Yield Savings Account or HYSA, there’s more to this new product (and how it moves) that I wish more people will pay attention to. I want to give you insight into what this new product could mean not only for the company but for consumer banking (shoot banking, period) -

The logistics -

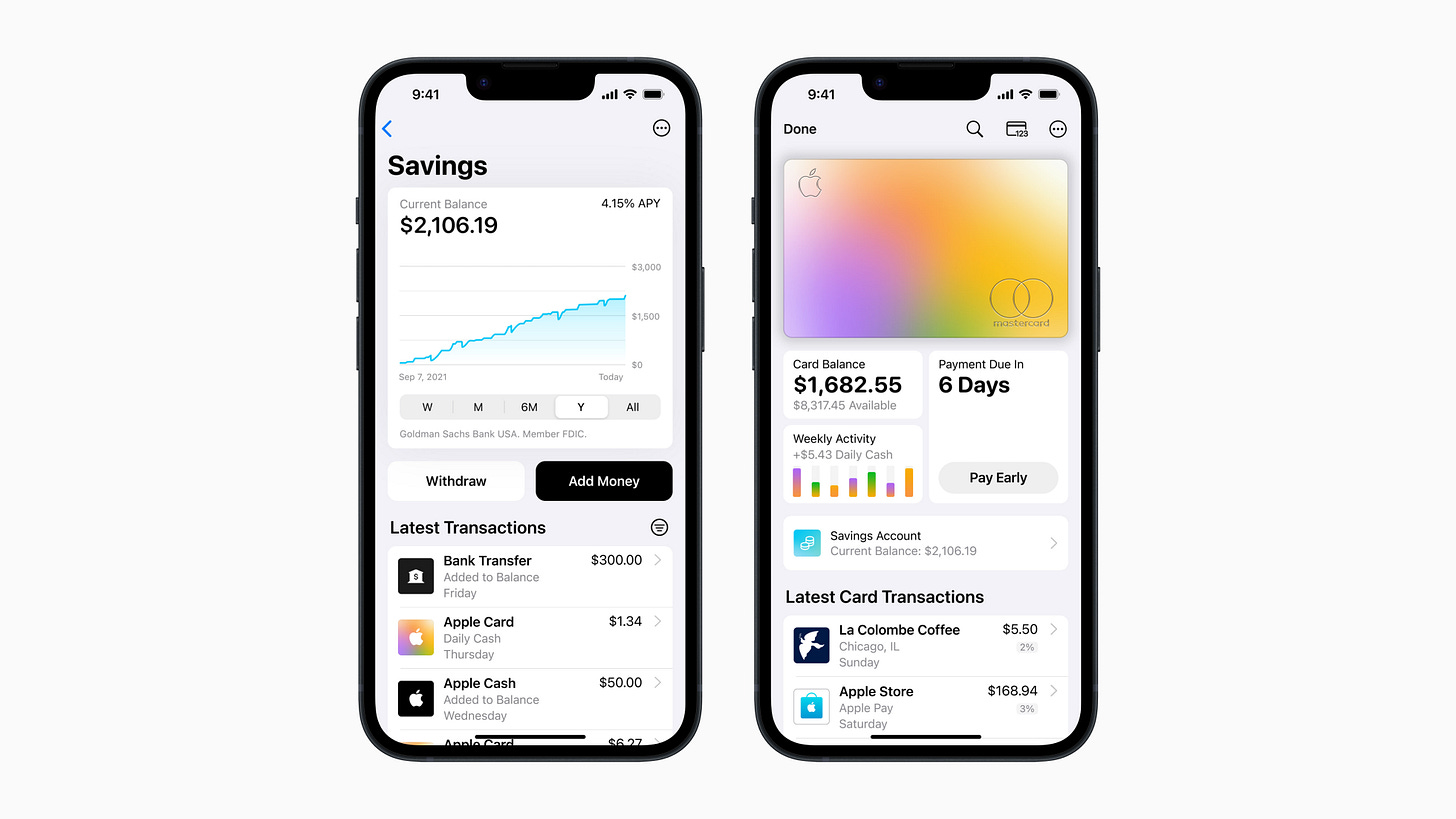

Over on Twitter, I talked about how the new Apple Savings will work. But let’s walk through it a bit more in-depth:

WTF or What The Finance is going on with it: Think of a High Yield Savings Account that’s through your Apple Wallet. While it’s a partnership with Goldman Sachs. Yes, GS has its own HYSA product - so this move by Apple is not only leveraging data but it could be telling how banks are noticing a shift when it comes to how consumers bank.

Compared to your regular savings account (barely 0.01%) this one gives you 4.15% APY. Banking. Marcus by Sachs gives me roughly 4.75%, others 3.9% APY. More deets:

Like the Apple Card itself, you must be a U.S. resident and 18+ to open a savings account.

Update your phone: iOS 16.4 or later required

The maximum balance allowed is $250,000 (you know, FDIC)

No fees, minimum deposits

More and more platforms like Apple, Public Invest, and even Robinhood are offering consumers ways for them to gain financial products without having them interact with the banks that have been causing them headaches over the years. Along with that Regular Savings accounts barely offer up any sort of incentive for savers. 0.01% APY doesn’t move the needle much when you’re saving - no matter for an emergency or vacation.

Apple will help Bank the unbanked, especially in developing countries - believe this.

Please don’t chase the rate/APY when it comes to HYSA/CDs. Due to the economy and Federal Reserve, interest rates go up and down. With us seeing the APR go up with hikes, we are also noticing that APYs (only with HYSA/CDs) are increasing. But they can easily go down. I’ve been with Marcus since 2018. Chase building your stacks consistently, not interest rates.

“If We Locked In, There’s No Switching Up”

The main thing about this is that you have to opt-in for an Apple Card to be able to open this account. Along with the fact that you have to have an iPhone, this not only screams exclusivity but shows how strong Apple is about owning its own Customer Journey. They want to engage and interact with their customers/audience from product to product. This move is even more critical for what they will do when expanding more into the FinTech model that I see them moving into in the short/long term future. What insights do they need to build the model tighter? Insights and Partnerships.

This new move with Goldman Sachs will allow Apple to understand the cash flow and customer flow to pair it with their own roadmap on the foundation gained from us as a customer. I say “us”, as I type from this MacBook Air and check my iPhone for notifications.

Uncle Warren Buffet said about Apple this:

"If someone offered you $10,000 to never buy an iPhone or Apple product ever again, you wouldn't take it.”

Apple knows this and this is why it’s starting to form more of a different business model than we were introduced to them years ago. Companies evolve and Apple knows that it has to move into this mode to evolve smarter.

Leaving The Bank -

But could this new Apple product trigger another type of bank run? Most were introduced to the term “bank run” with the whole situation with SVB, but this new shift that we are seeing with banking is showing another one might be coming.

Banks are shifting not only their footprint to consumer lending but also their forecast of how consumers will spend, save, and invest. One of the things that I noticed when working for the bank was how few savings accounts were being opened. No real incentive for consumers when you offer them 0.01% to pool their money into the collectiveness of the banks.

I talked about the possibility of a different type of bank run here:

Investors Insight:

Why should investors lock eyes with not only what Apple is doing but also the banking industry? There are two things (of many) that I watch with companies (that I invest in) - 2C: [Market] Capitalization and Cash.

Apple has one of the best set up of 2C that I’ve seen:

There’s no cap on their Market Capitalization. They have a $2.66 Trillion Market Capitalization, which makes them the most valuable country in the world (by Market Cap). But looking at how the market cap matches the GDP of other counties is insane.

And seeing what Tim Cook is planning for international impact isn’t something to ignore as an investor.

The other C is cash.

Oftentimes when a company is up for potential sale, it is if Apple (along with Amazon + Google) would purchase them. The reason is that cash reverse/flow is important for companies. Not only to survive during uncertain times like this but to invest in other companies via stake or to acquire them. Apple has roughly $202.6 Billion in cash and we saw how important that was for them when they were in talks to purchase WaveOne. While the deal went under the radar with all of the latest AI talks, this is very important for investors to watch for with companies they plan on purchasing through stocks or ETFs.

The Bite -

What Apple is doing with not only the Savings, PayLater, Card, and whatever is to come is to impact their reach globally but also align with a lane to drive them there..with FinTech capabilities. Heck, Walmart is doing this at its level. I do expect more brands that are within the same vein as Apple to expand and evolve to not dissolve in the future. But with more companies going into the FinTech sector, this is a signal that Banks - you’re in danger girl.