Throw It In The Bag: Thoughts About BNPL

Buy Now, Pay Later is a glamorized layaway, but is it laying the ground work for more?

The landscape of the Buy Now, Pay Later Space has been growing at warp speed throughout the pandemic. While I deemed it to be a glamorized layaway, the impact that we are experiencing in various industries proves that it isn’t slow down on applying more pressure.

The How: Depending on the platform you’re using, you would find the item you want and there would be an option to pay with the partnered platform (i.e. Amazon - Afterpay). You will be presented with the terms and conditions that come with your purchase via a micro loan. Your payment schedule would be laid out like a mat when you check out.

The Hiccup: Over the last couple of months, we have seen articles highlighting how they could be debt-causing vehicles that drive people further away from generational wealth and freedom. Especially those who identify as Gen Z and some Millennials. Which, the stats give a peep show into how it could go if you don’t fully have the discipline to handle such. Also, due to it being a reoccurring loan - missed payments and the line of credit shows up on your credit report.

The Hyphen: While it can seem damning for people to use it to purchase the latest things, it also gives help to those who need it. I talked about a while ago how QuickTrip allows you to purchase gas via the BNPL method and other companies like Instacart are giving those who need it a way to purchase groceries and goods. Even BNPL entering the health sector.

With the launch of Apple Pay Later and other platforms like Chase offering the same formula in a lane with around 360 million users - the context shows that it isn’t just Gen Z using it. With a market share that’s worth over $150 billion, my initial theory of it not slowing down but showing a lot of layers of convenience and the placement of currency when it comes to consumerism.

The notion with statistics is that they can paint the picture in which they want to be seen. Despite the 16% of BNPL being Gen Z, the information barrier needs to show for what they use it for. It’s already stated that more and more Americans are using Credit Cards, pulling from 401K plans and using other methods, perhaps BNPL, to stay afloat. That gap that’s wider than someone’s teeth between the amount someone’s life cost and how much income/cash flows has been shown more throughout this ‘great reset’ we have been forced into. The group project when it comes to wealth/economics proves that two things can be right at the same time - [some] people need more money to manage while [some] people need to manage their money better.

When it comes to BNPL being the offspring of layaway, it proves that the cycle of currency has shifted to benefit some while keeping some the same. Like other topics, I see the balance in things like BNPL, Crypto, Investing, and Community Economics. I believe it’s due to being on this side of the coin and working for those who used to flip it. I do see the good in BNPL, helping those who need to get some high-ass eggs while they’re between paychecks; and the not-so-good - causing debt to those who can’t budget for it.

Here are some thoughts that I have about what we are/ will see in the BNPL space:

Apply Pay Later is just the tip of the iceberg: I already know that Google Pay will implement something like this and other financial institutions as well. The thing about it is how would it show up in the footprint of their infrastructure. How would they make it organic and not just the opportunist feel that some can have when it comes to the finance industry? The “pay-in-four” will be used heavily.

Here’s my rundown of the Apple Pay Later + Card push from October

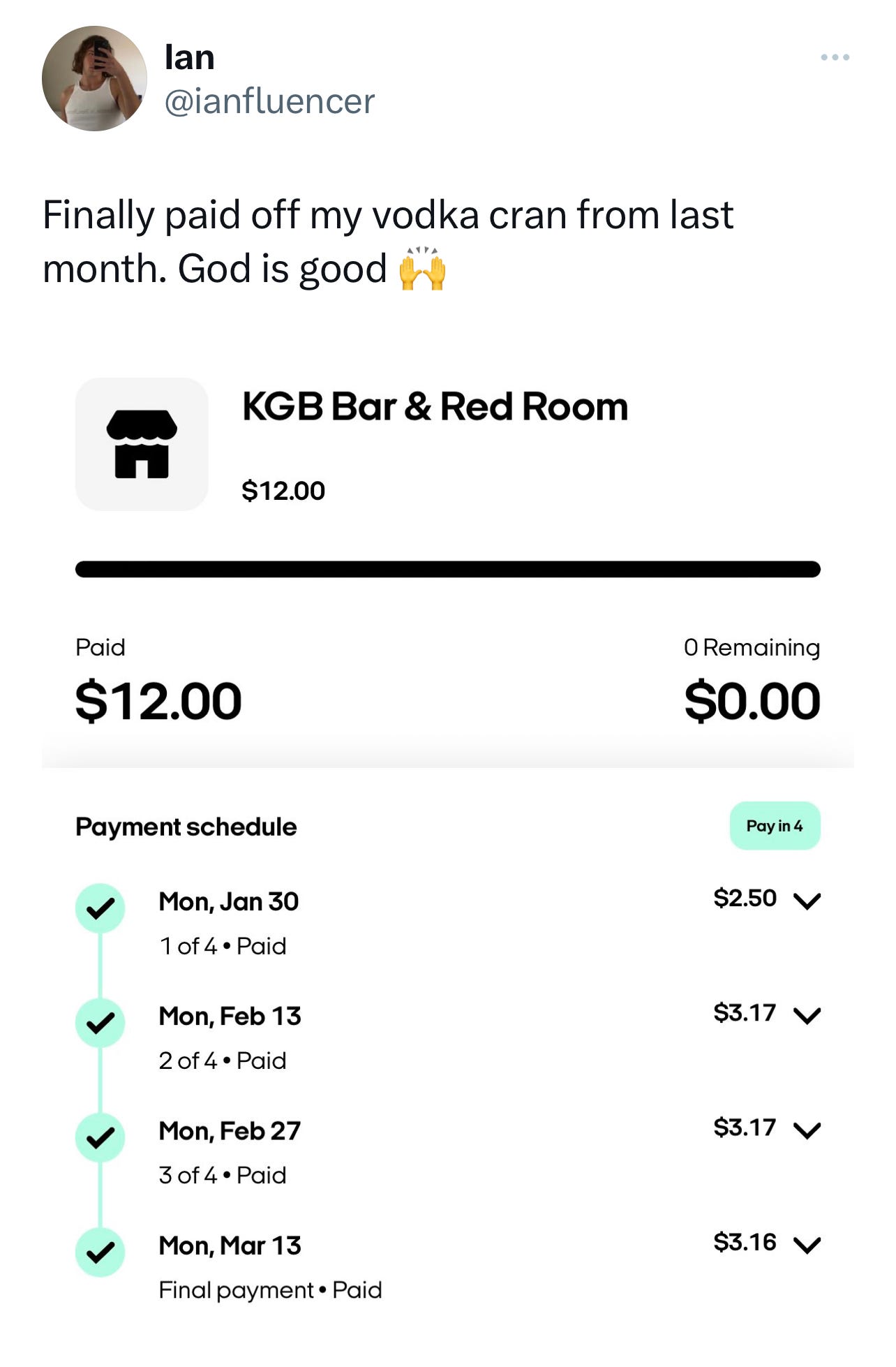

BNPL is more than just clothes and goods. Companies/merchants are starting to implement it within their threshold. I saw this over on Twitter a while ago where you could get a drink (or dwank) and you could put it on Afterpay. Even Afterpay goes in on the commentary. Could it also become a community alignment for brands (my marketing mind is always thinking)?

I [want to] see the good in BNPL. Throughout the pandemic, more and more people saw inflation pop the other cheek of their budgets to make it go up even more than we saw before the shutdowns. While we were fighting for tissue, some were fighting to balance their new budgets when the old one wasn’t secure. The pivots of industries like healthcare, and utilities could help people afford their lives. But at the same time, I wonder about the fees or surcharges that can come with it. Would it be deepening the hole that many face when it comes to their finances? It’s like a spectrum with the light being unsure.

I want to see more offer education when it comes to BNPL. I believe that the finance sector needs to show up more in educating their consumers/audience about what their product does and how to use it effectively. In retrospect, it will get people to use it properly. Maybe that’s what I’m here for, but I believe that’s a sound foundation. When I worked for Snoopy I pushed for more education to be within the marketing for annuity products. But then again, the target audience for annuities was different. I’m saying a lot without saying it.

I have more theories about BNPL that I will tackle as they come about. But thinking about when I talked about it well over a year ago, it’s not slowing down anytime soon. I just want people to add a budget line for it just as with anything else. Understand the balance (if possible) between the spend and splurging for said thing. Heck, you can budget for the TELFAR's, either use it on Klarna or save for the drop.

Throw it in the bag looks totally different now. I’m not The Dream, I’m just looking in the bag differently than most.